August 27th, 2025

If you think pizza is just crust and toppings, think again. For Gen Z it’s an entire experience that starts on their phone and ends with a story (and maybe a TikTok). Gen Z make up almost 20% or 67 million of US population and are reshaping how pizza restaurants get discovered, ordered from and recommended.

To better understand how Gen Z in USA prefer to order, discover, compare and use loyalty programs at pizza restaurants, we surveyed 530 Gen Z adults (18-25 years old) and asked them about their pizza ordering preferences. Below are the key findings along with demographics and survey methodology discussed at the end.

Nearly 70% of Gen Z respondents (69.8%) say they order pizza at least once a week with 41.5% ordering multiple times per week and 28.3% ordering weekly. Another 28.3% report ordering pizza 1–3 times per month, and just 1.9% order less than once per month.

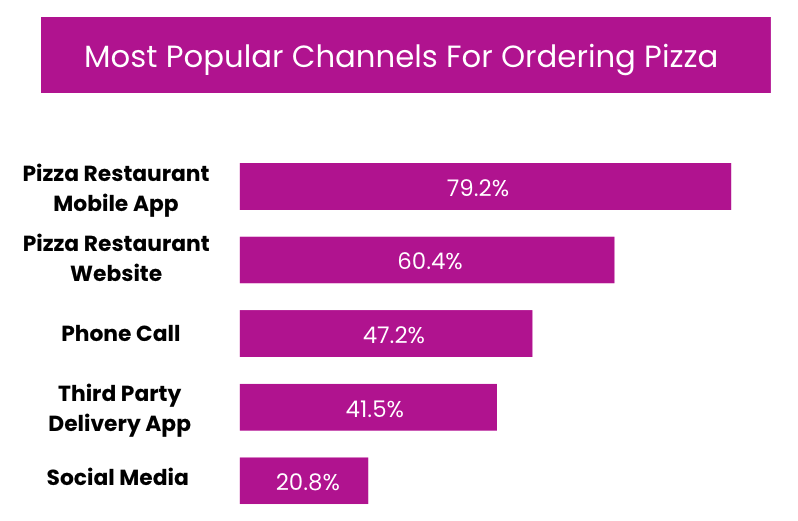

Among Gen Z respondents, restaurant mobile apps are the go-to for ordering pizza used by 79.2%, followed by restaurant websites at 60.4%. Phone orders remain surprisingly common (47.2%), while third-party delivery apps like UberEats/DoorDash/Grubhub are used by 41.5%. A quarter still walk in to order (26.4%), social-media ordering shows up for about one in five (20.8%), and chatbots are nearly unused (1.9%).

Most Gen Z buyers typically spend in the mid-price band with 43.4% usually spending $20–$29 per order. About 24.5% spend $10–$19, 13.2% fall in the $30–$39 range, and 18.9% are willing to spend $40 or more. The majority of orders sit mid-range, but there’s a meaningful slice willing to pay up for larger or premium pies.

Mobile rules: 73.6% of Gen Z place pizza orders on a mobile device, about 24.5% use a desktop or laptop, and tablets are almost negligible (1.9%).

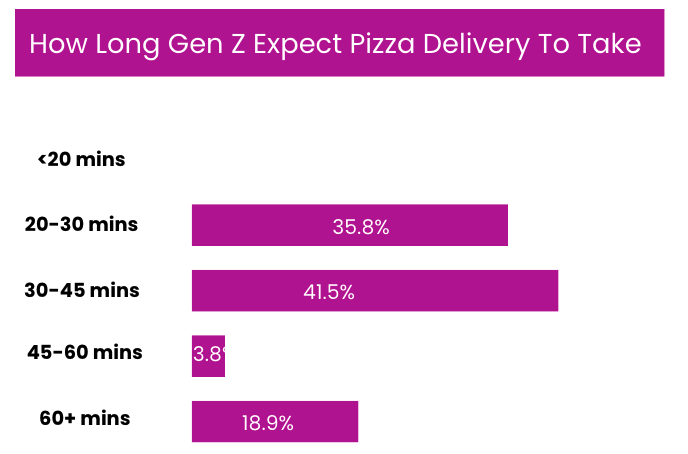

Most Gen Z customers expect pizza within a reasonable window and the bulk want it in 20–45 minutes (about 35.8% say 20–30 minutes and 41.5% say 30–45 minutes). Far fewer are okay waiting 45–60 minutes (~3.8%), while ~18.9% will tolerate 60+ minutes. Virtually none expect it in under 20 minutes.

Price is a major factor for Gen Z when choosing where to order pizza with three-quarters rating price as Important or Very Important (about 41.5% Important; 34% Very Important). Only a small share feel neutral (9.4%) or somewhat important (15.1%), and virtually none say price is unimportant. In short: competitive pricing and clear value offers matter especially if you want repeat orders from younger customers.

Real-time tracking matters a lot to Gen Z pizza buyers with nearly 80% saying they want to see their order tracking in real time when placing an order. Only a small share are neutral (5.7%) or see it as somewhat important (13.2%), with almost no one dismissing it outright.

When it comes to delivery style, most Gen Z pizza buyers still prefer the personal touch, 64.2% favor hand-to-hand delivery. About 18.9% opt for contactless drop-offs, while 17% don’t have a strong preference either way.

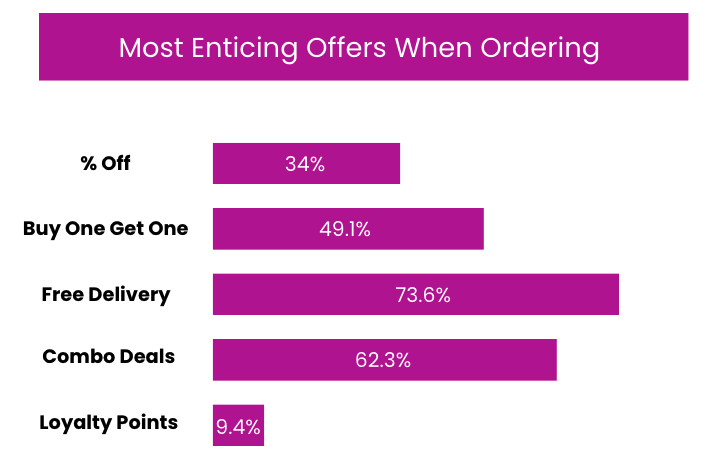

The special offers that resonate most with Gen Z are all about value and convenience. Free delivery leads the pack at 73.6%, followed by combo deals (62.3%) and buy-one-get-one offers (49.1%). Standard discounts (34%) hold some appeal, while loyalty points rank lowest (9.4%), showing that immediate savings beat long-term rewards for this group.

The largest share of Gen Z tippers leave 20% (30.2%). Next most common are 15% and 25% (both 20.8%), followed by 10% (15.1%). The least common is 18% (13.2%). Bottom line: most hover around 15–20%, with a notable chunk going 25%.

Loyalty programs have strong traction with Gen Z pizza fans, 83% say they’re members of at least one, while only 17% aren’t enrolled anywhere. This shows younger consumers are highly receptive to rewards and incentives when it comes to their favorite pizza spots.

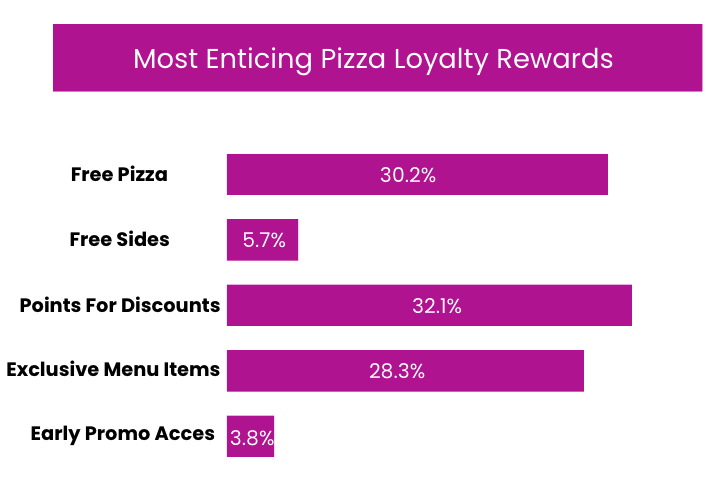

When it comes to loyalty rewards, Gen Z is most motivated by points they can redeem for discounts (32.1%), closely followed by free pizza (30.2%) and exclusive menu items (28.3%). Free sides (5.7%) and early promotion access (3.8%) are far less compelling, showing that tangible, high-value rewards drive the most engagement.

Eco-friendly packaging matters to Gen Z: a combined 76.1% say it’s Important (45.3%) or Very Important (30.2%) when ordering pizza. A smaller share are neutral (13.2%), and only a handful see it as not or only somewhat important (11.3%). This shows sustainability is more than a nice-to-have – it’s a real driver of brand perception.

When asked if they’d place a pizza order with AI, most Gen Z respondents said no (73.6%), while just over a quarter (26.4%) said they’d be open to it. This suggests curiosity exists, but trust and adoption still have a long way to go before AI ordering feels mainstream.

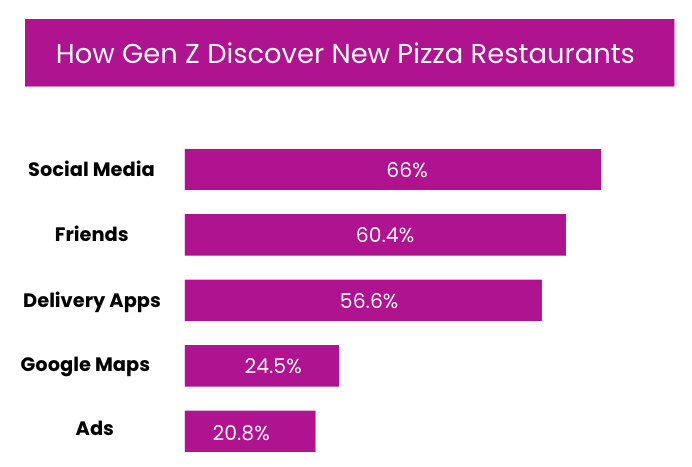

Gen Z tends to discover new pizza spots through the channels they already use every day. Social media (66%) tops the list, followed closely by friends (60.4%) and delivery apps (56.6%). Traditional discovery methods rank much lower, only 24.5% say Google Maps and 20.8% cite ads. This highlights just how social and app-driven Gen Z’s food discovery really is.

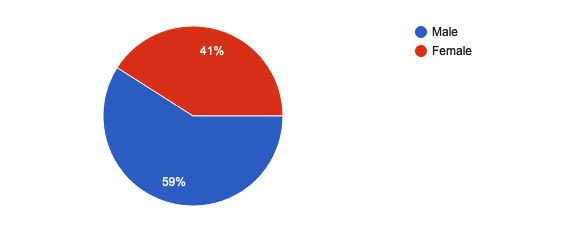

The demographic composition of Gen Z adults was set to 18-25 years old with gender selection opt in and state identification to ensure results did not have location bias.

For the purpose of this survey, we surveyed 530 Gen Z adults across America to see how they order, discover, compare and use loyalty programs at pizza restaurants. The survey was carried out online on August 25-26, 2025 using Amazon Survey Services.

If you have any questions or issues with the data presented in this report, please contact us.