September 24th, 2025

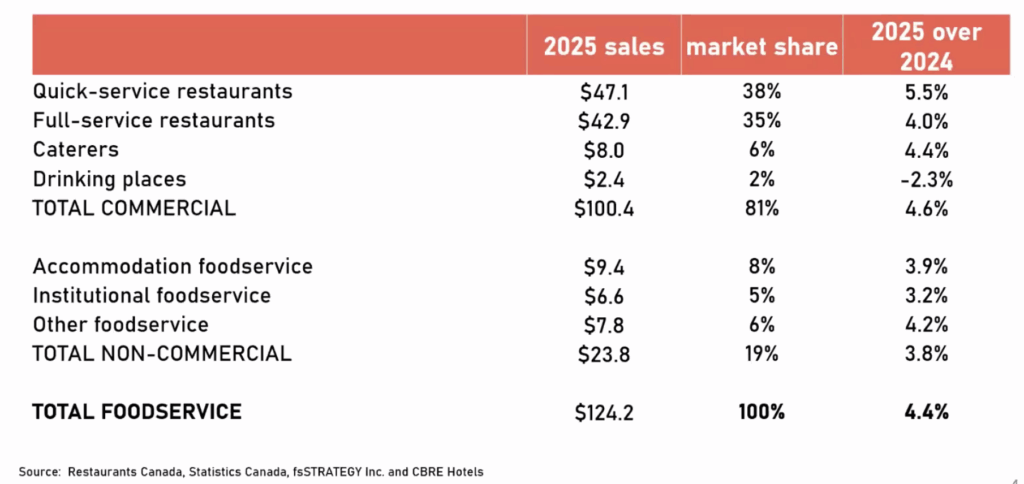

As Canada’s foodservice industry heads into the final quarter of 2025, restaurant operators face both opportunities and challenges. Total foodservice sales are projected to hit $124.2 billion this year, up 4.4% from 2024 according to Restaurants Canada. But behind that headline growth lies a more complex reality of shifting consumer behaviour, economic pressures, and operational hurdles.

Here are the 7 key trends (based on Restaurants Canada data) that restaurant operators need to keep in mind for Q4 2025:

Canadian foodservice sales are set to reach $124.2B in 2025, but real growth is modest.

QSRs are the largest and fastest-growing segment, expanding at 5.5%.

75% of Canadians are dining out less, but cheque size gains lag inflation.

Profitability remains thin, with only 60% of restaurants profitable.

Economic headwinds will persist into 2026.

Technology (from inventory management to loyalty tools) is the best path to resilience.

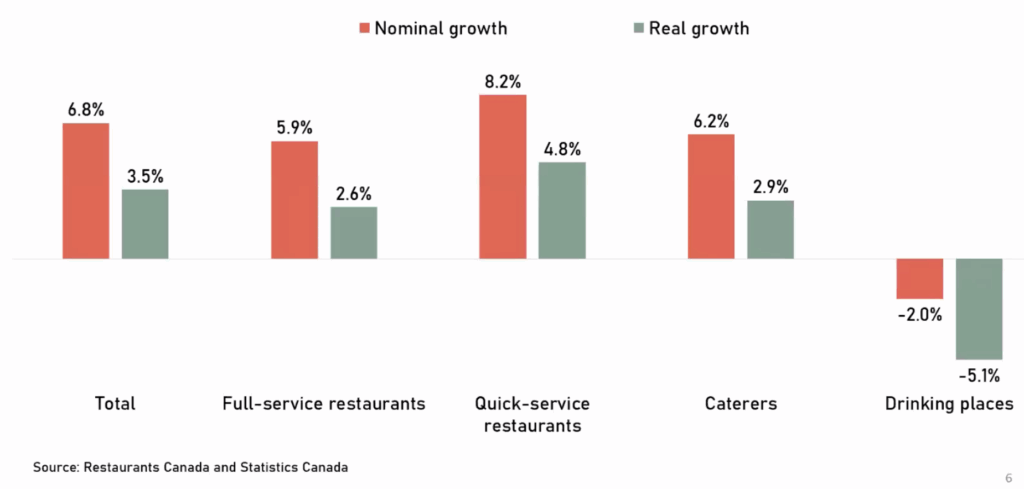

Growth numbers may look encouraging on the surface, but inflation is masking the real story.

Takeaway: Focus on efficiency (not just sales) to drive true growth.

When it comes to resilience, quick-service restaurants are outpacing the rest of the industry.

QSRs remain the largest segment at $47.1 billion.

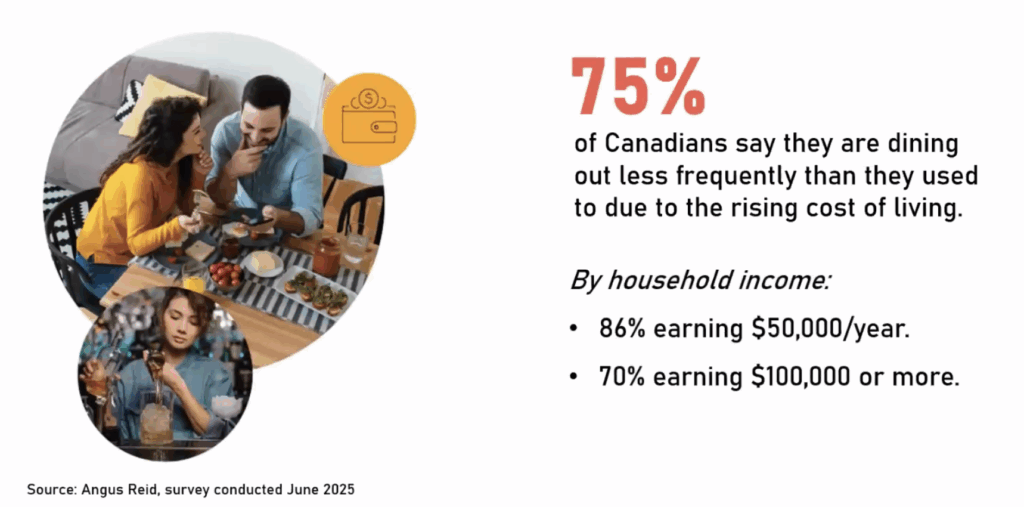

Economic pressures are forcing Canadians to think twice about dining out.

Takeaway: Operators must maximize the value of every customer visit.

Even when guests do dine out, their spending habits are shifting.

Takeaway: Customers are trading down, upselling and loyalty can help close the gap.

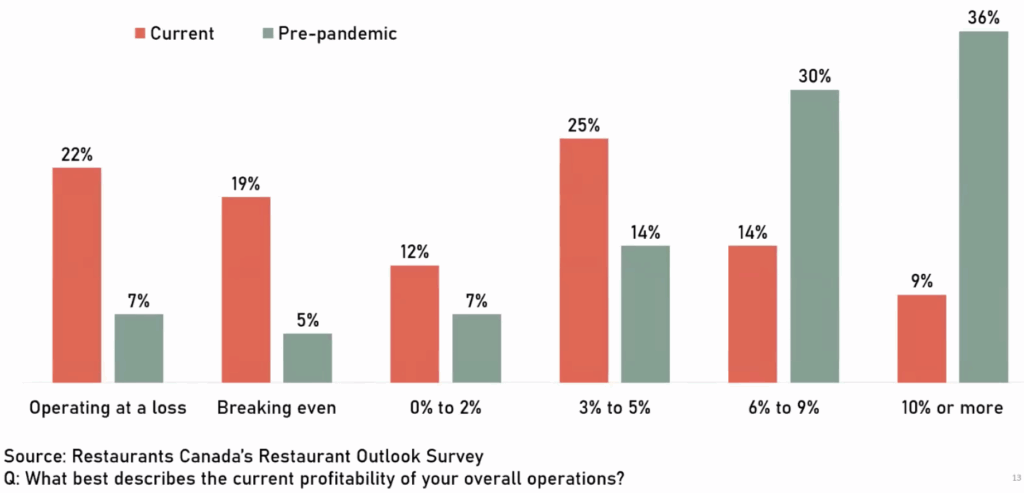

Despite signs of recovery, margins remain razor-thin for many operators.

Takeaway: Operators must double down on cost control and efficiency.

The broader economic climate is adding pressure to the industry.

Takeaway: Expect conservative spending patterns into 2026.

Digital tools are no longer optional, they’re essential for competitiveness.

Takeaway: Technology is now essential for both efficiency and customer engagement.

Q4 2025 will test Canadian restaurant operators’ ability to adapt. With consumers dining out less, profitability under pressure, and economic growth slowing, efficiency and customer engagement are critical. Quick-service restaurants are leading the way, but across all segments, the winners will be those who embrace technology, control costs, and stay in tune with changing consumer behaviour.

Rising cost-of-living pressures have led 75% of Canadians to cut back, even among high-income households.

Quick-service restaurants (QSRs) are leading the industry, with sales of $47.1B and growth of 5.5%, outpacing full-service restaurants.

Not fully. Only 60% are profitable, while 40% are still breaking even or losing money. Margins remain well below pre-pandemic levels.