January 30th, 2024

In the dynamic landscape of the modern food industry, the emergence of cloud kitchens has sparked a transformative shift in the way we perceive and experience dining. Often referred to as virtual kitchens or ghost kitchens, the global cloud kitchen market is projected to reach $112.5 billion in 2027.

But what is a cloud kitchen? This article delves into the meaning and intricacies of cloud kitchens, shedding light on their operations and cost, and unveiling the latest trends shaping this restaurant business model.

A cloud kitchen, also known as a virtual kitchen or ghost kitchen, refers to a centralized facility designed for the sole purpose of preparing and fulfilling food orders for delivery and takeout. Unlike traditional dine in restaurants, cloud kitchens operate without a physical storefront or dine-in space, focusing exclusively on the efficiency of food production and order fulfillment for online platforms.

The concept of cloud kitchens has gained prominence with the rise of food delivery services and the shift in consumer preferences toward convenient, on-demand dining experiences. Cloud kitchens provide a flexible and scalable solution for culinary entrepreneurs to experiment with different cuisines, concepts, and virtual brands without the overhead costs associated with traditional restaurants.

Cost Efficiency: Cloud kitchens eliminate the need for prime real estate and the costs associated with maintaining a traditional dine in restaurant, such as rent, utilities, and staffing for front-of-house operations.

Flexibility and Innovation: Cloud kitchens provide a platform for culinary entrepreneurs to experiment with different cuisines, menus, and concepts without the constraints of a physical dining space.

Technology Integration: Cloud kitchens leverage technology for order processing, inventory management, and data analytics, leading to more efficient and data-driven operations. Integration with online delivery platforms and a strong online presence enhance visibility and accessibility for customers.

Focus on Core Operations: Without the need for a physical dining area, cloud kitchens can focus solely on the core aspects of food preparation, ensuring consistent quality and timely order fulfillment. Eliminating front-of-house operations allows for a streamlined kitchen environment with a focus on maximizing production efficiency.

Adaptability to Market Trends: Cloud kitchens can quickly adapt to changing consumer preferences and market trends, allowing operators to introduce new menu items or concepts in response to customer demand.

Limited Brand Visibility: Cloud kitchens operate without a traditional storefront, limiting brand visibility compared to restaurants with a physical presence that can attract foot traffic.

Lack Of Customer Interaction: Without a dine-in option, cloud kitchens may face challenges in establishing direct relationships with customers, impacting brand loyalty and repeat business.

Dependency on Third-Party Platforms: Relying on third-party food delivery platforms for order fulfillment often involves significant commission fees, which can eat into profit margins.

Competition in Online Space: The online food delivery market can be highly competitive, with numerous virtual brands and cloud kitchens vying for customer attention.

Quality Control Assurance: Maintaining consistent food quality across multiple brands or concepts operating from the same kitchen space can be challenging.

A cloud kitchen operates as a virtual and centralized hub for food production, designed exclusively for fulfilling delivery and takeout orders. The strategic location of these kitchens is often chosen based on factors such as proximity to residential areas, delivery routes, and target demographics. The kitchen’s infrastructure is optimized for streamlined operations, featuring shared facilities and equipment to efficiently accommodate the simultaneous preparation of diverse menus.

Technology plays a central role in the operation of cloud kitchens, with advanced Order Management Systems (OMS) managing incoming orders, organizing kitchen workflows, and facilitating communication between kitchen staff and delivery personnel. Point-of-sale (POS) systems are integrated with online platforms to handle payments, inventory management, and sales tracking.

Cloud kitchens collaborate with popular food delivery platforms like Uber Eats, DoorDash, or Skip The Dishes. Integration with these platforms ensures seamless order placement, real-time tracking, and timely delivery. Cloud kitchen operators negotiate commission fees (15%-30%) with delivery platforms, recognizing the crucial role these platforms play in connecting virtual brands with a broad customer base.

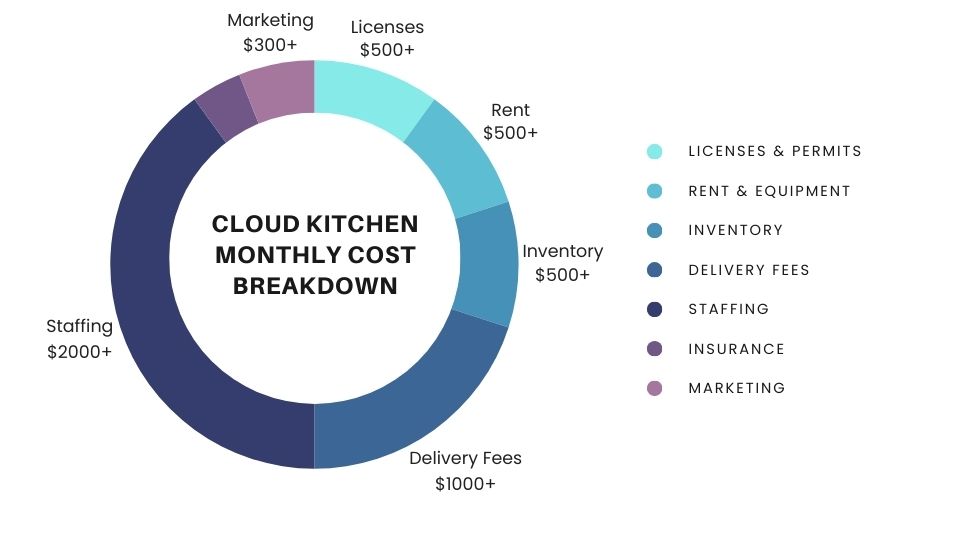

The startup costs for a ghost kitchen can range from $20,000 – $60,000 or more, depending on various factors plus monthly recurring costs such as rent, inventory and staffing. This estimate is highly variable and should be used as a starting point for a more detailed financial analysis based on your specific business plan and circumstances. Below is an estimated breakdown of various costs by category that you will incur initially or on recurring monthly basis.

Licenses, Permits & Insurance: The costs for licenses, permits, and insurance for a cloud kitchen restaurant can range from a few thousand to tens of thousands of dollars annually, depending on factors such as location, business size, and specific regulatory requirements.

Rent & Equipment: The costs for rent and equipment for a cloud kitchen restaurant can vary widely, with monthly rent ranging from $500 to $10,000 or more and initial equipment expenses ranging from $10,000 to $100,000.

Inventory: The cost of inventory for a cloud kitchen restaurant can range anywhere from $500 to $20,000 per month, depending on factors like menu diversity, ingredient quality, and the volume of orders.

POS & Software: The costs for point-of-sale (POS) systems and delivery fees for a cloud kitchen restaurant can vary, with POS systems typically incurring upfront costs ranging from $1,000 to $5,000, while delivery fees from third-party platforms may range from 15% to 30% of the order value.

Staffing: The cost of staffing for can vary based on the size of the operation and roles required, starting from $2,000 for one person ran operations to $25,000+ for large operations.

The cloud kitchen industry is undergoing tectonic shifts and has been under significant pressure since the end of COVID-19 and the return by customers to dine in restaurants. Here are our top five trends for the industry in 2024 and beyond.

1. Virtual Brand Proliferation:

The continued growth and diversification of virtual brands within cloud kitchens. Operators are creating multiple virtual concepts to cater to different cuisines, dietary preferences, or specific food trends. This trend allows for increased flexibility and adaptation to evolving consumer demands.

2. Advanced Technology Integration:

Increased adoption of advanced technologies to enhance efficiency and customer experience. This includes the use of AI for data analytics, smart kitchen systems, and robotics to optimize operations, streamline workflows, and improve order accuracy.

3. Sustainability Initiatives:

Growing emphasis on sustainability within cloud kitchen operations. This trend involves eco-friendly packaging, sourcing local and sustainable ingredients, and implementing environmentally conscious practices to reduce the ecological impact of food delivery services.

4. Global Expansion and Market Consolidation:

Cloud kitchen operators seeking to expand their reach beyond local markets and, in some cases, globally. Simultaneously, there is a trend toward market consolidation, with larger players acquiring smaller cloud kitchen businesses to strengthen their market presence.

5. Health-Conscious Menus:

Increasing demand for health-focused and wellness-oriented menu options. Cloud kitchens are responding to consumer preferences for fresh, nutritious, and balanced meals. This includes offerings for specific diets such as plant-based, gluten-free, or low-carb options.

The future for cloud kitchens is poised for continued growth and innovation as technology, consumer preferences, and market dynamics evolve. As the demand for convenient and on-demand dining experiences persists, cloud kitchens are likely to play a central role in reshaping the restaurant industry, offering entrepreneurs and established brands opportunities to thrive in the evolving food service landscape.

The terms “ghost kitchen” and “cloud kitchen” are often used interchangeably, but a subtle distinction exists; while both refer to virtual kitchens focused on delivery and takeout, “ghost kitchen” may imply a complete absence of a physical presence, whereas “cloud kitchen” is a broader term that includes virtual operations but may also encompass kitchens associated with existing physical restaurants.

The startup capital to start a cloud kitchen in Canada is $20,000 or more with a monthly recurring cost of $5,000+ if you’re running the operation yourself and already have kitchen space.

Other names for cloud kitchens include virtual kitchen, ghost kitchen, dark kitchen, shared kitchen, and delivery-only kitchen.

The terms “cloud kitchen” and “dark kitchen” are often used interchangeably, but “cloud kitchen” may emphasize a virtual, online presence, while “dark kitchen” may specifically refer to a kitchen optimized for delivery-only operations with minimal or no dine-in facility.

The size of a cloud kitchen can vary, but it is typically designed for efficiency rather than spacious dine-in facilities, and its size depends on factors such as the number of virtual brands operated, the volume of orders, and the available kitchen infrastructure.