September 29th, 2025

The Canadian restaurant industry in 2025 is not a single unified market but four distinct ones. Data from Restaurants Canada and Angus Reid shows that success requires tailoring strategies to the unique habits, expectations, and values of each generation. Restaurant operators who apply a one-size-fits-all approach risk missing opportunities, while those who adapt stand to capture loyalty and maximize spend across age groups.

Below is a blueprint for understanding generational diners and the operational shifts needed to win their business.

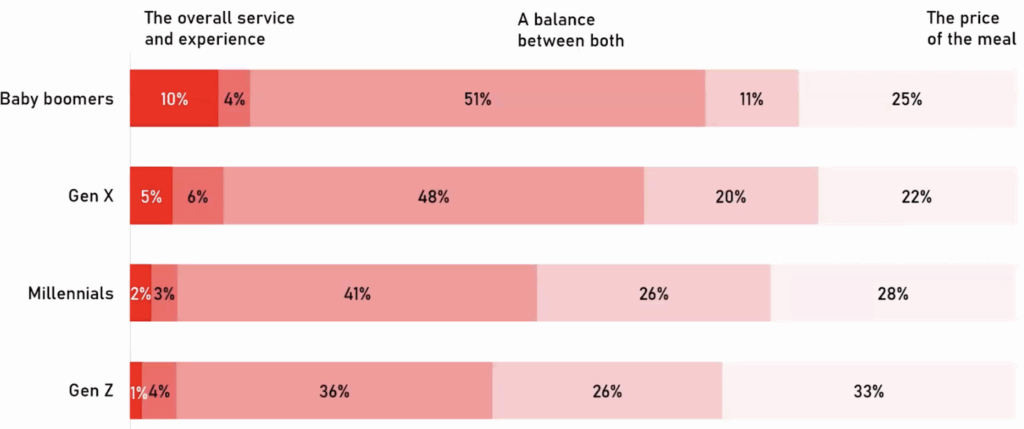

Gen Z: Frequent diners, but frugal. Focus on TikTok-driven marketing, affordable menus, and seamless digital ordering.

Millennials: Highest frequency diners. Value variety, aesthetics, and tech-friendly dining with online reservations and polished branding.

Gen X: Biggest spenders. Prioritize quality, reliability, and loyalty-building programs.

Boomers: Traditionalists. Value personal service, consistency, and accessible, comfortable environments.

Digital-first strategies: Gen Z and Millennials require heavy investment in social media, delivery integrations, and mobile-friendly ordering.

Experience vs. familiarity: Younger cohorts seek novelty and experiences, while older ones prioritize comfort and tradition.

Alcohol consumption: Gen Z’s reduced interest in alcohol means creative mocktails and non-alcoholic programs are essential.

Service quality: A universal differentiator, whether efficient (Gen Z), authentic (Millennials), consistent (Gen X), or personal (Boomers).

Menu strategy: Younger groups embrace experimentation, while older ones want reliability and quality.

No single strategy wins: Restaurants must adapt across generations to remain competitive in 2025’s fragmented dining market.

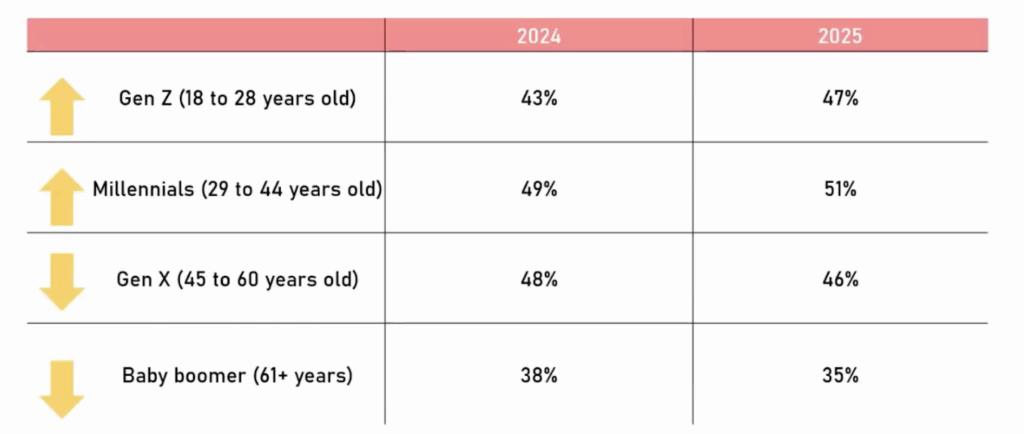

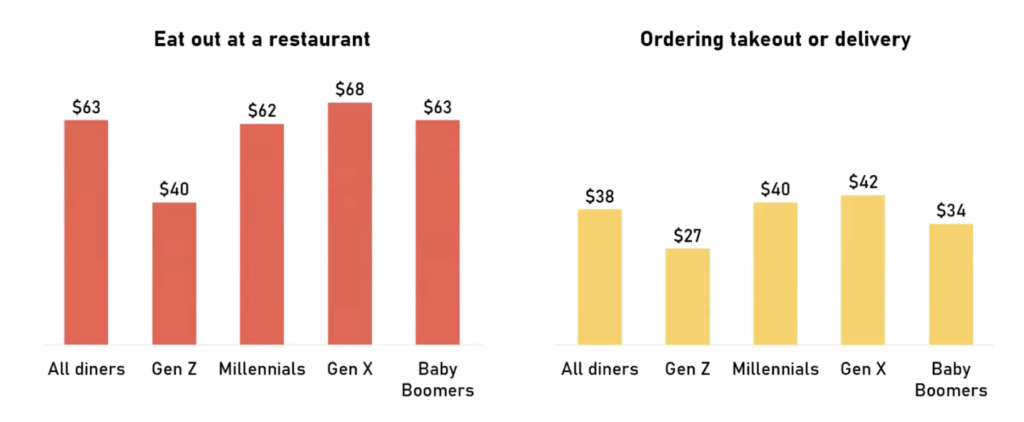

Gen Z dines out often (47% do so weekly) but spends the least ($40 for dine-in, $27 for takeout). This generation views the restaurant experience through a digital-first lens, from discovery to payment. They are also driving cultural changes, such as reduced alcohol consumption and heightened demand for affordability.

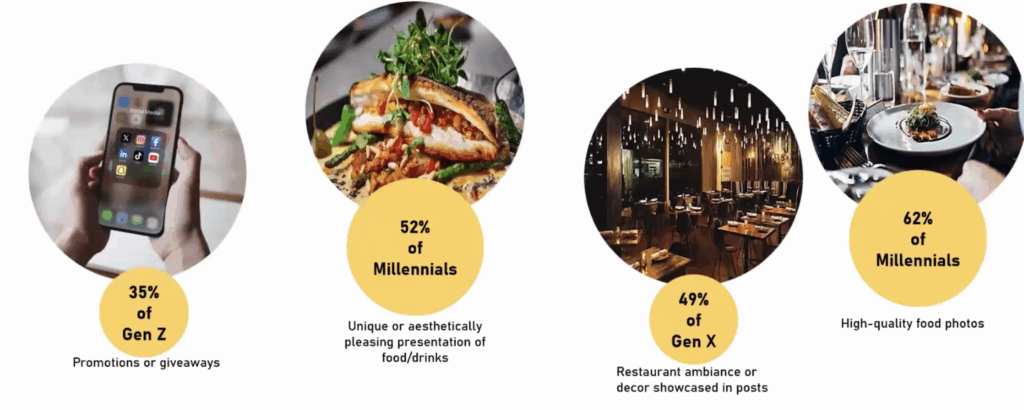

Marketing & Acquisition: Run campaigns on TikTok and Instagram that prioritize visual appeal, novelty, and affordability. Use giveaways and user-generated content to drive engagement.

Technology & Ordering Systems: Prioritize seamless integration with third-party delivery apps (54% use them) and offer fast, mobile-friendly ordering with tap or pay-at-table features.

Menu & Product Development: Offer affordable, customizable dishes with strong visual appeal. A bold non-alcoholic beverage program with mocktails and specialty drinks is a must.

Service & On-Premise Experience: Speed, control, and tech-enabled environments matter. Provide outlets, Wi-Fi, and lighting designed for social media photos.

Millennials are the restaurant industry’s engine, with 51% dining out weekly. They balance their tech-savviness with a desire for new experiences, variety, and aesthetics. Willing to spend more than Gen Z ($62 per dine-in visit), they value restaurants that deliver both innovation and atmosphere.

Marketing & Acquisition: Invest in professional food photography and an Instagram-friendly brand presence. Showcase your restaurant’s unique vibe across channels.

Technology & Ordering Systems: Online reservations, waitlist apps (65% adoption), and tabletop tablets (57% adoption) enhance their experience. A polished first-party website is a competitive edge.

Menu & Product Development: Rotate menus seasonally, introduce global cuisines, and feature limited-time offers. A curated mocktail and cocktail program strengthens appeal.

Service & On-Premise Experience: Train staff to speak knowledgeably and authentically about food. Millennials expect attentive but non-intrusive service within a well-curated ambiance.

Gen X represents slightly lower frequency (46% weekly) but the highest spend ($68 per dine-in). They are a “quality over quantity” demographic, driven by trust, loyalty, and consistency. Restaurants that deliver reliably will win repeat business from this cohort.

Marketing & Acquisition: Emphasize quality, consistency, and atmosphere. Showcase décor and ambiance online, and implement loyalty programs tailored to repeat visits.

Technology & Ordering Systems: Keep systems simple, clean, and reliable. A functional website with easy online ordering is more valuable than flashy tools.

Menu & Product Development: Prioritize premium ingredients and expert execution. A curated wine and spirits list aligns with their preferences.

Service & On-Premise Experience: Gen X values professionalism and consistency. Well-trained staff and a polished dining environment are essential. Notably, 64% are comfortable dining alone.

Dining frequency is lowest among Boomers (35% weekly), but they represent a deeply loyal base. They value tradition, comfort, and attentive service. Less tech-reliant, Boomers prefer personal interactions and straightforward hospitality.

Marketing & Acquisition: Reputation and word-of-mouth are most important. Maintain an easy-to-navigate website with clear hours and contact details.

Technology & Ordering Systems: Keep the telephone line active and efficient, as 49% prefer it for orders. Ensure printed menus are available.

Menu & Product Development: Stick to familiar, well-executed classics. Consistency outweighs experimentation for this generation.

Service & On-Premise Experience: Personal, respectful service is key. Spaces must be comfortable, well-lit, and accessible. Building rapport ensures long-term loyalty.

Canada’s restaurant market in 2025 is defined by generational differences. Gen Z and Millennials are shaping the future with digital-first expectations and a desire for experiences, while Gen X and Baby Boomers ground the industry in tradition, quality, and personal service. The challenge for operators is balancing these sometimes competing demands. The solution lies in segmentation: identify your core audience, tailor the dining journey to their values, and adapt operationally.

The Canadian dining scene will reward those who can be flexible while offering value to Gen Z, variety to Millennials, consistency to Gen X, and tradition to Boomers.

Gen X (ages 45–60) has the highest average spend per visit at $68 for dine-in, making them a key high-value segment.

Despite lower average checks, Gen Z are frequent diners and trendsetters whose choices influence broader food culture, making them essential for long-term growth.