November 10th, 2025

Ontario’s 2025 Fall Economic Statement as part of Plan To Protect Ontario introduces a wide range of fiscal, regulatory, and sector-specific measures that directly impact the province’s restaurant industry, an industry already navigating rising labour costs, supply chain volatility, and shifting consumer habits.

From tax relief and workforce programs to major changes in alcohol distribution and tourism investments, the Fall Statement outlines several policy shifts that can influence profitability, operations, hiring, and long-term planning for foodservice operators.

The following article highlights the most important updates restaurant owners need to know to stay competitive and prepared heading into 2026.

Ontario has reduced the small business corporate tax rate to 3.2% and expanded eligibility, lowering the tax burden for many restaurants.

The Employer Health Tax exemption increased to $1 million in payroll, meaning most small and mid-sized restaurants pay no EHT.

A record WSIB premium reduction and $4B rebate lowers mandatory insurance costs for hospitality employers.

Ontario increased minimum wage to $17.60/hr on Oct 1, 2025, raising labour costs for restaurants.

The province has extended the wholesale alcohol discount for restaurants until Dec 31, 2025, improving bar margins.

Starting in 2026, the LCBO becomes the exclusive alcohol wholesaler with a new pricing model, simplifying alcohol purchasing for restaurants.

Ontario is investing billions in electricity and fuel tax relief, keeping hydro bills and delivery costs lower for restaurants.

New digital modernization grants help restaurants adopt online ordering, POS, inventory tools, cybersecurity, and AI systems.

Major investments in tourism regions like Niagara, Wasaga Beach, and Toronto waterfront are expected to increase restaurant traffic.

Ontario’s red tape reduction plan and unified digital permit system will make licensing, expansions, and renovations faster and easier for restaurant businesses.

Ontario has reduced the small business corporate income tax rate to 3.2%, down from 3.5%, and expanded eligibility for this lower rate. This tax cut lowers the income tax burden on incorporated restaurants that qualify as small businesses, helping them retain more profits for reinvestment or debt repayment.

Ontario also chose not to implement a federal measure that would have hiked taxes on small companies earning significant passive investment income, thereby preserving the preferential tax treatment for many business owners.

The annual payroll exemption for Ontario’s Employer Health Tax was doubled from $490,000 to $1 million. This means many small and mid-sized restaurants no longer pay the EHT if their total payroll is under $1 million, directly reducing their labor-related taxes.

Workplace Safety and Insurance Board (WSIB) premiums have been reduced to their lowest rate in 50 years, lowering mandatory insurance costs for employers in industries like hospitality. In addition, WSIB is issuing a one-time $4 billion surplus rebate in 2025 to eligible businesses. Restaurant operators who contribute to WSIB may receive a rebate and will benefit from the ongoing lower premium rates.

The provincial taxes on fuel have been cut and made permanent to help reduce operating and distribution costs. Gasoline is taxed 5.7 cents per litre less, and diesel (fuel) 5.3 cents per litre less, than it was prior to the cut. These cuts, which were extended through June 30, 2025 and then set as permanent on July 1, 2025, help lower the cost of deliveries and transportation for restaurant supplies and food distributors.

Ontario had previously lowered high Business Education Tax (BET) rates (a component of commercial property tax) across the province. As of 2021, this move is providing about $450 million in annual savings to businesses – about 95% of all business properties saw a reduction in their property tax rate. Restaurant owners leasing space may see these savings passed on in the form of lower rent or TMI charges, especially in areas that historically had higher BET rates.

In response to economic pressures (such as U.S. tariffs), the province offered a six-month interest- and penalty-free period for certain provincially administered taxes. Around 80,000 businesses benefitted from the deferral of select tax payments, freeing up cash flow of up to $9 billion to help keep staff employed and weather challenging months. While this was a time-limited relief measure, it signifies Ontario’s willingness to grant temporary tax deferrals in extraordinary circumstances, which could be replicated in future crises impacting the hospitality sector.

Effective October 1, 2025, Ontario’s general minimum wage increased from $17.20 to $17.60 per hour. This change, tied to the Ontario Consumer Price Index (inflation), directly impacts restaurants by raising the base pay for servers, kitchen staff, and other hourly employees. Over 800,000 workers benefitted from this increase.

Restaurant operators should budget for higher wage costs and may need to adjust menu pricing or scheduling to accommodate the roughly 2.3% pay raise for minimum-wage staff. The annual October adjustment provides predictability, as it reflects inflation while aiming to keep labor costs competitive with economic conditions.

The Skills Development Fund (SDF) has received a commitment of $2.5 billion to support training programs and new training facilities. Since 2021, SDF-funded projects have helped over 1,000,000 workers upgrade their skills or train for in-demand jobs. While many SDF projects target manufacturing, construction and health care, hospitality organizations can partner with training providers to access funding for skills training (for example, culinary skills, management training, or safe food handling programs).

The Better Jobs Ontario program (formerly Second Career) received an additional $50 million in funding in 2025. This program provides financial support to unemployed or underemployed people to train for high-demand jobs. A new fast-track stream prioritizes workers from “trade-impacted” sectors (industries affected by tariffs). In practice, this could help displaced workers (e.g. from manufacturing) retrain for careers in growing sectors – potentially including culinary or hospitality roles – which might expand the pool of skilled labor available to restaurants. Since 2021, nearly 18,000 job seekers have been retrained through this program.

Ontario passed legislation (the Protect Ontario by Cutting Red Tape Act, 2025 and Building a More Competitive Economy Act, 2025) that, among other things, makes it easier to recruit skilled workers from other provinces:

No new restrictive employment laws (such as scheduling regulations or workplace mandates) were introduced in this Fall Statement. The focus remains on upskilling and talent availability rather than adding regulatory burdens on employers.

To help small businesses modernize, Ontario has invested $7.5 million through the Digitalization Competence Centre for digital adoption initiatives. This includes $5 million for the Digital Modernization and Adoption Plan (DMAP) to assist small and medium enterprises (SMEs) in assessing their digital needs and creating effective tech adoption strategies.

In addition, $2.5 million is allocated for matching grants to small retail businesses to adopt new digital technologies. For restaurant operators, this program is an opportunity to upgrade point-of-sale systems, implement e-commerce/delivery platforms, or enhance cybersecurity, with part of the costs covered by the grant.

Ontario announced a $2 million investment in Futurpreneur Canada to support young entrepreneurs (aged 18–39) in 2025. Futurpreneur provides mentorship, startup coaching, and up to $75,000 in loan capital (in partnership with BDC) for new businesses.

This means aspiring restaurateurs in the 18–39 age range can access financing and mentorship to launch a new restaurant or foodservice concept. Existing restaurant owners could also benefit indirectly, as this program encourages new entrants (e.g. a new franchisee or food truck operator) and could be used by current young managers to buy into a business.

To expand financing options for small businesses, Ontario is proposing to modernize credit union rules. Legislative amendments to the Credit Unions and Caisses Populaires Act will allow credit unions to raise capital from non-members.

This change will enable Ontario credit unions to access more funds and in turn increase lending to local businesses. For restaurant operators, this could mean more availability of business loans or lines of credit through credit unions, with potentially competitive interest rates.

The province is committed to keeping electricity rates “affordable and stable” for households and small businesses. The Ontario Electricity Rebate (OER) is continuing, which currently provides a rebate (in the form of a percentage discount) on electricity bills for eligible small commercial customers.

This program, along with other electricity cost relief initiatives, helps keep small business hydro bills low and predictable – a significant benefit for restaurants, which tend to be energy-intensive (due to kitchen equipment, refrigeration, lighting, HVAC, etc.).

For slightly larger operations (e.g. big restaurants, banquet halls, or food processing facilities that don’t qualify for the small business rate class), Ontario’s Comprehensive Electricity Plan has been in effect since 2021. It is reducing electricity costs by an average of 11%–14% in 2025 for medium-sized and larger commercial/industrial customers.

If your restaurant is a high-volume user on a general service tariff (for example, demand above 50 kW), you should be seeing substantially lower hydro costs than you would have without this plan. Essentially, the province subsidizes a portion of the global cost of power generation to keep rates competitive for businesses.

The provincial portion of the gas and fuel taxes has been permanently cut (5.7¢/L on gasoline and 5.3¢/L on diesel). This cut, which was initially temporary, was extended through mid-2025 and then made permanent as of July 1, 2025. As a result, restaurant owners benefit from slightly cheaper gasoline – important for any business that uses vehicles for catering, delivery, or supply runs – and lower freight costs that can trickle down in the form of smaller price increases from suppliers.

To support the hospitality industry, Ontario has been reducing the LCBO’s wholesale prices for bars and restaurants. This wholesale discount (in place since the pandemic recovery period) continues through December 31, 2025. Practically, licensed restaurants and bars pay a lower price when buying alcohol (beer, wine, spirits) from the LCBO than the regular retail price, improving their profit margins on beverage sales.

Be aware that this is a time-limited measure – after 2025 the pricing structure will change with the new model (described next). Restaurant operators should plan beverage menus and pricing with the knowledge that current alcohol cost savings will remain in effect through 2025.

The Fall Statement announces a major policy shift: Starting in 2026, the LCBO will become the exclusive wholesaler for all beverage alcohol in Ontario, including beer, wine, and spirits for restaurants, bars, and retail stores. Along with this, a new alcohol wholesale pricing model will be implemented to streamline and simplify the system, ensuring a level playing field for all market participants. What this means for restaurants:

Instead of dealing with multiple suppliers (like the Beer Store or individual breweries for beer, and the LCBO for wine/spirits), restaurants will be able to source all alcoholic products through the LCBO wholesale channel. This could simplify ordering and invoicing, and potentially improve price consistency.

As part of the Grow Ontario agri-food strategy, in July 2025 the federal and provincial governments announced $4.4 million for 90 projects under the Sustainable Canadian Agricultural Partnership (Sustainable CAP). These projects are funded through Ontario’s Food Safety and Growth Initiative and aim to help small agri-food businesses improve their food safety and traceability systems and grow their operations.

This means upstream suppliers – farms, processors, distributors – are getting support to adopt better technology and practices for safety and efficiency. For restaurants, a stronger emphasis on traceability can improve food safety (knowing that ingredients have better tracking from farm to table). It also can reduce the chance of disruptions; for example, if there’s a recall or issue, traceability helps isolate the problem faster, potentially avoiding widespread shortages.

The backdrop of the Fall Statement is the challenge of U.S.-imposed tariffs. Ontario is investing in domestic supply chains and encouraging diversification of trade. This includes funding for critical minerals (for electric vehicles, etc.) and manufacturing, but also measures like temporarily restricting some public-sector procurement from foreign sources to protect domestic industries.

For restaurants, the immediate impact is indirect – these policies aim to prevent price spikes or shortages that could happen if supply chains were overly dependent on tariffed imports. The more Ontario (and Canada) can produce essential goods domestically or find alternate markets, the less likely that geopolitical trade issues will lead to missing menu items or cost volatility.

Ontario’s 2025 Fall Economic Statement signals a clear shift toward strengthening local businesses, supporting workforce development, and modernizing the regulatory environment, all of which have direct implications for restaurant operators across the province.

Between tax relief, energy savings, digital adoption support, and sweeping alcohol reforms, restaurants are positioned to benefit from lower operating costs and increased access to tools that improve efficiency. By understanding these policy changes and leveraging the available programs, Ontario restaurants can better navigate economic pressures and position themselves for sustainable growth heading into 2026 and beyond.

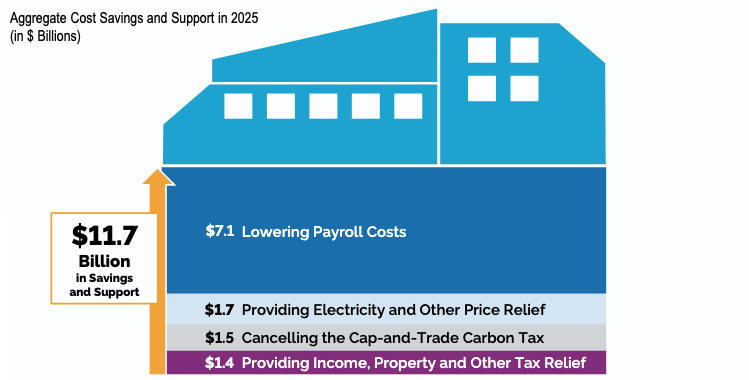

The reduced small business tax rate (3.2%), expanded eligibility, and the higher $1 million Employer Health Tax exemption provide meaningful tax savings for many restaurants.

The rise to $17.60/hr increases labour costs, requiring operators to review staffing models, scheduling efficiency, and menu pricing strategies to maintain margins.

Yes, Ontario is continuing electricity subsidies and has permanently lowered provincial fuel taxes, helping restaurants manage hydro bills, heating costs, and delivery-related expenses.