November 25th, 2024

The Canadian government just announced that consumers will no longer need to pay GST/HST on restaurant meals (dine-in, takeout and delivery) from Dec. 14, 2024 – Feb. 15, 2025. This stimulus is expected to provide significant boost to restaurant sales during this period and especially impact the lowest sales month of January.

According to Restaurants Canada projections, the GST/HST pause that’s coming can result in a 5% increase in sales for an average restaurant. But what does that 5% increase translate to in gross dollar value for the Canadian restaurant industry?

This report uses Statistics Canada data, Restaurants Canada data and our own data on the number of restaurants in Canada to project the financial ramifications of GST/HST pause on the Canadian restaurant industry.

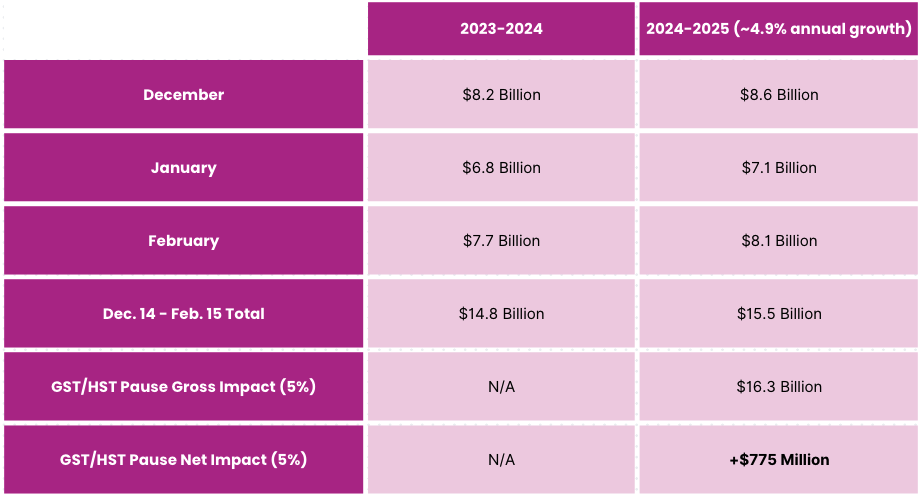

Restaurants Canada anticipates the annual sales growth of 4.9% from 2023 to 2024 for the Canadian restaurant sector while Statistics Canada data shows food services and drinking places sales of $8.2 billion for December 2023, $6.8 billion for January 2024 and $7.7 billion for February 2024.

By taking into account the projected growth rates, past 12 months history of restaurants sales and projected increase of 5% in sales from GST/HST pause, we estimate that Canadian restaurant industry is projected to experience a $775 million sales increase from Dec. 14, 2024 – Feb. 15, 2025 as a result of GST/HST pause.

There are 108,313 restaurants in Canada according to Google Maps data we published earlier this year in How Many Restaurants Are In Canada report. Given this number and projected $775 million gain in sales across the entire Canadian restaurant sector due to GST/HST pause, an average increase in gross sales per restaurant will be $7,155 from Dec. 14, 2024 – Feb. 15, 2025.

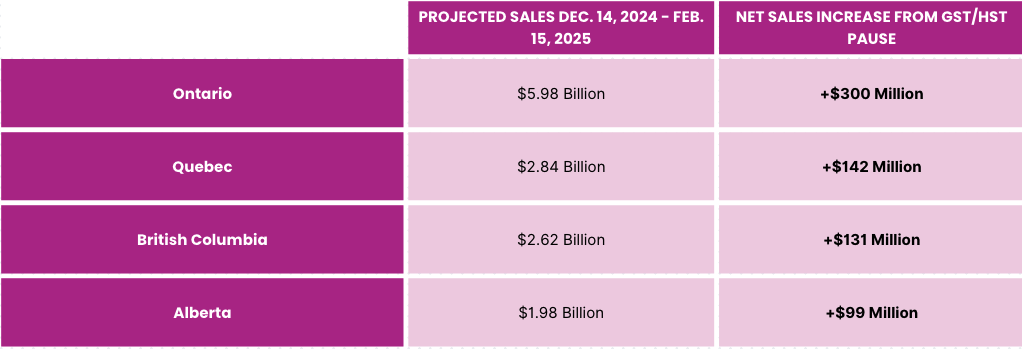

Using Statistics Canada data on province based restaurant sales from the past 12 months and Restaurants Canada projections model, Ontario restaurants are expected to net an additional $300 million, Quebec restaurants $142 million, British Columbia $131 million and Alberta $99 million in sales as a result of GST/HST pause during Dec. 14, 2024 – Feb. 15, 2025.

From December 14, 2024 to February 15, 2025.

Yes the GST/HST pause affects all restaurants in Canada and includes dine-in, takeout and delivery meals.

The GST/HST pause is no longer in effect and consumers are required to pay for all dine-in, takeout and delivery meals with tax.